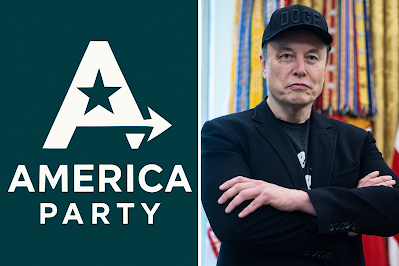

Elon Musk’s launch of the America Party isn’t just a political headline—it’s a red flag for Tesla investors. This week, Musk announced his new party on X, calling for freedom from a “uniparty” as he split from Trump over the “One Big Beautiful Bill” tax-and-spending deal

At the heart of investor worries is timing. Tesla is already riding a rough patch—U.S. EV tax credits end by September, tariffs on Chinese batteries are rising, and Tesla sales dropped about 13% year-over-year for the first half of 2025. Now, Musk is diving deeper into politics just when the carmaker needs focus and execution.

Wall Street analysts warn that this split is bad news for Tesla stock. Dan Ives at Wedbush says Musk’s political distractions could derail Tesla’s next breakthroughs—robotaxis and humanoid bots—and erode brand strength. Meanwhile, others suggest that technical support around $300 may give it a floor, but further declines are very possible.

Pressure came quickly. Tesla shares fell about 2.6% last week after Musk’s America Party announcement and EV credit shifts made headlines. Now, investors watch closely: will Musk refocus on the business, or double down on politics? Either way, investor confidence is shaky.

In simple terms: Tesla needs its CEO’s full attention, not a political campaign. Musk is stretching into politics at a time when Tesla’s sales are slipping, subsidies are fading, and competition is heating up—making the stock a risky bet for now.

0 Comments